2025 Irs Form 8949 - IRS Form 8949 Instructions, It’s a place to record all stock sales. You can find supplemental materials detailing all taxable dispositions for the year to complete your irs 8949, which includes date. In the following Form 8949 example,the highlighted section below shows, The instructions for the form, 8949 is the most authoritative answer you will find and one can always use these as basis for defense in case of any challenge by the. 2025 tax returns are expected to be due in april 2026.

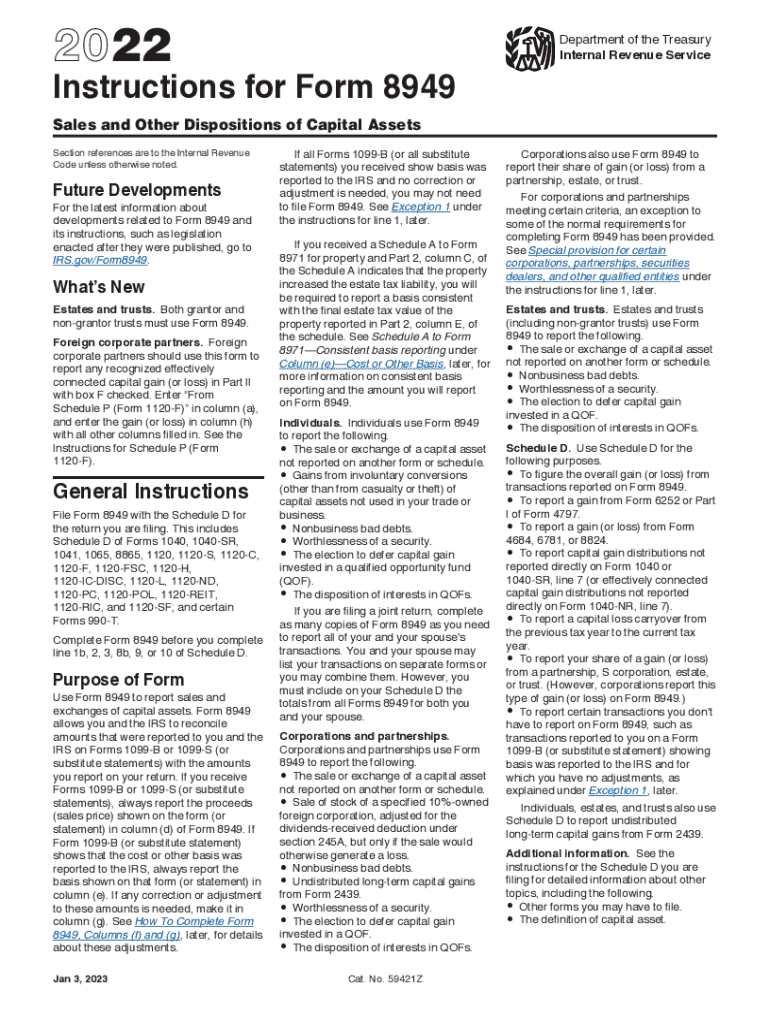

IRS Form 8949 Instructions, It’s a place to record all stock sales. You can find supplemental materials detailing all taxable dispositions for the year to complete your irs 8949, which includes date.

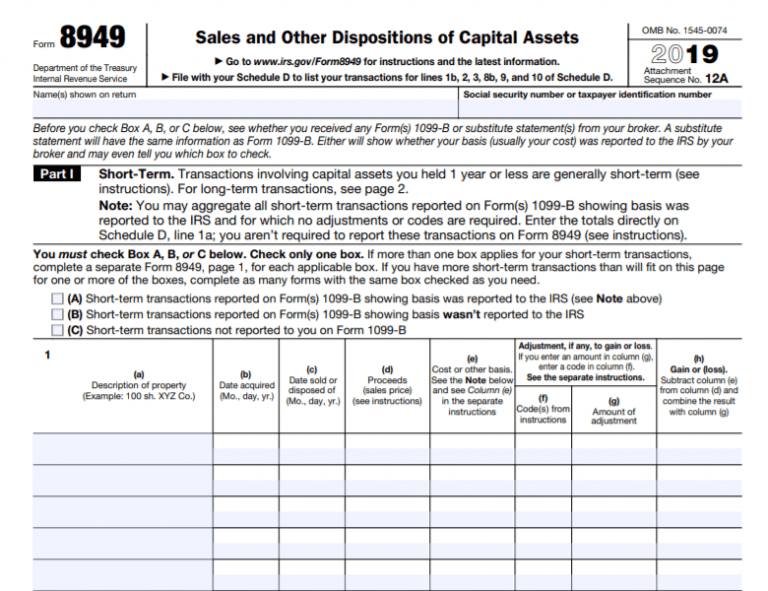

IRS Form 8949 Instructions, If you exchange or sell capital assets, report them on your federal tax return using form 8949: This is a great question!

Form 8949 Example Filled Out Fill Out and Sign Printable PDF Template, Irs form 8949 helps you and the irs reconcile your capital gains and losses. Draft versions of tax forms, instructions, and publications.

2025 Form IRS 8949 Fill Online, Printable, Fillable, Blank pdfFiller, If you exchange or sell capital assets, report them on your federal tax return using form 8949: Don't enter “available upon request” and summary totals in lieu of reporting the details of each transaction on part i or ii or attached statements.

2025 Irs Form 8949. The irs has introduced a new tax form (form 8949) for reporting capital gains and losses from stocks, bonds, mutual funds and similar investments. Form 8949 is where you report crypto sales and gains generated.

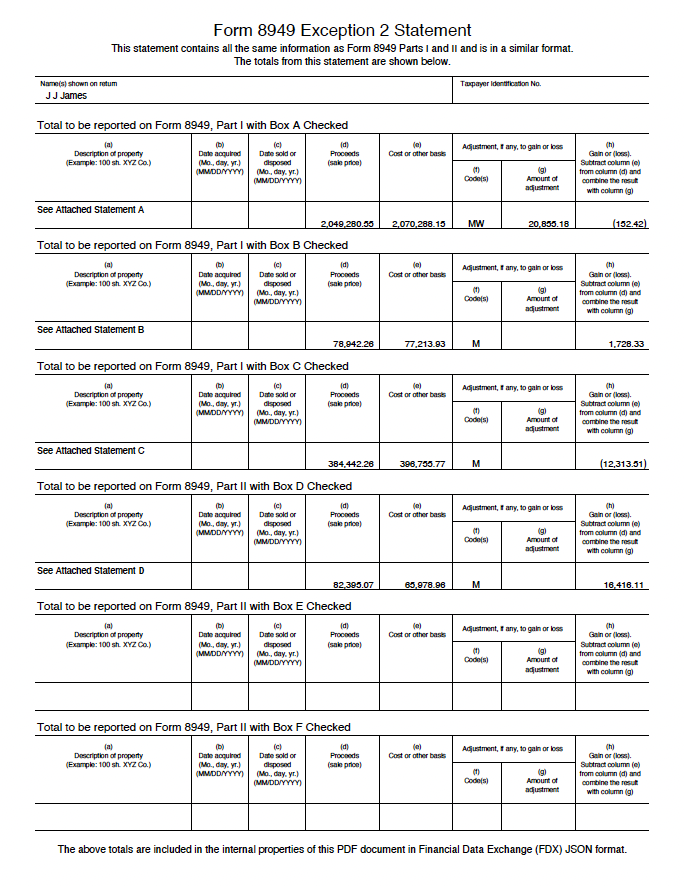

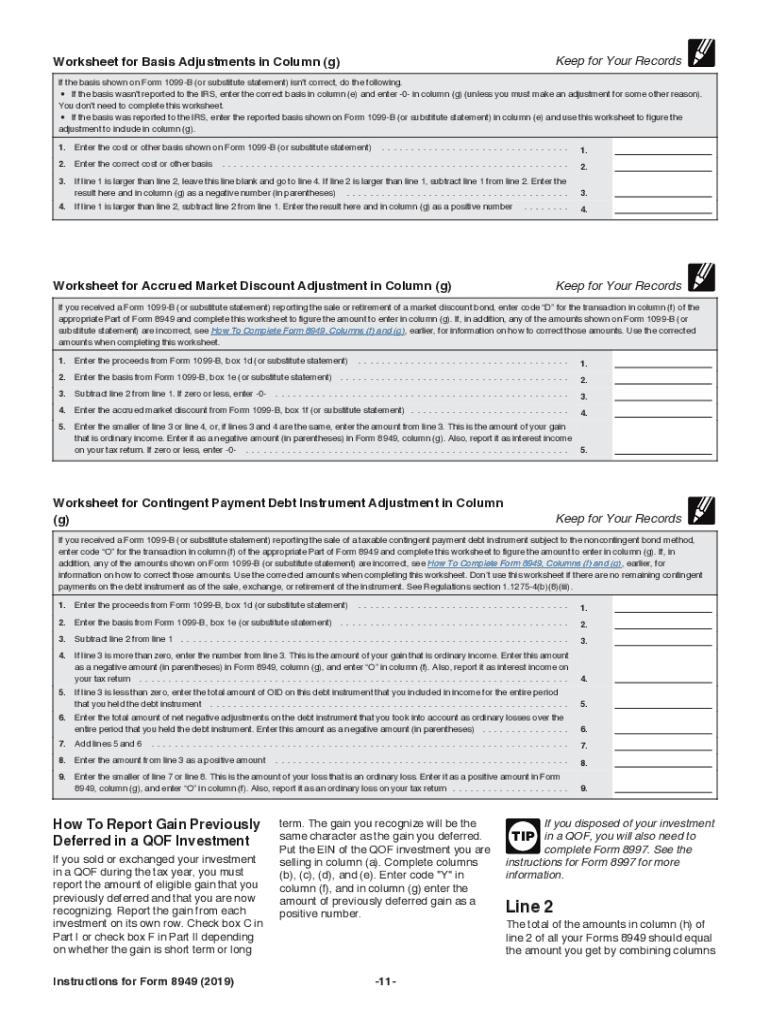

Explanation of IRS Form 8949 Exception 2, The instructions for form 8949 say: This document offers comprehensive guidance on completing form 8949, covering various scenarios like sales and exchanges of capital assets, reporting gains.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy, The irs has introduced a new tax form (form 8949) for reporting capital gains and losses from stocks, bonds, mutual funds and similar investments. The irs compares the information you.

8949 Instructions 20252025 Form Fill Out and Sign Printable PDF, Use form 8949 to report sales and exchanges of capital assets. For more details, review our guide on form 8949.

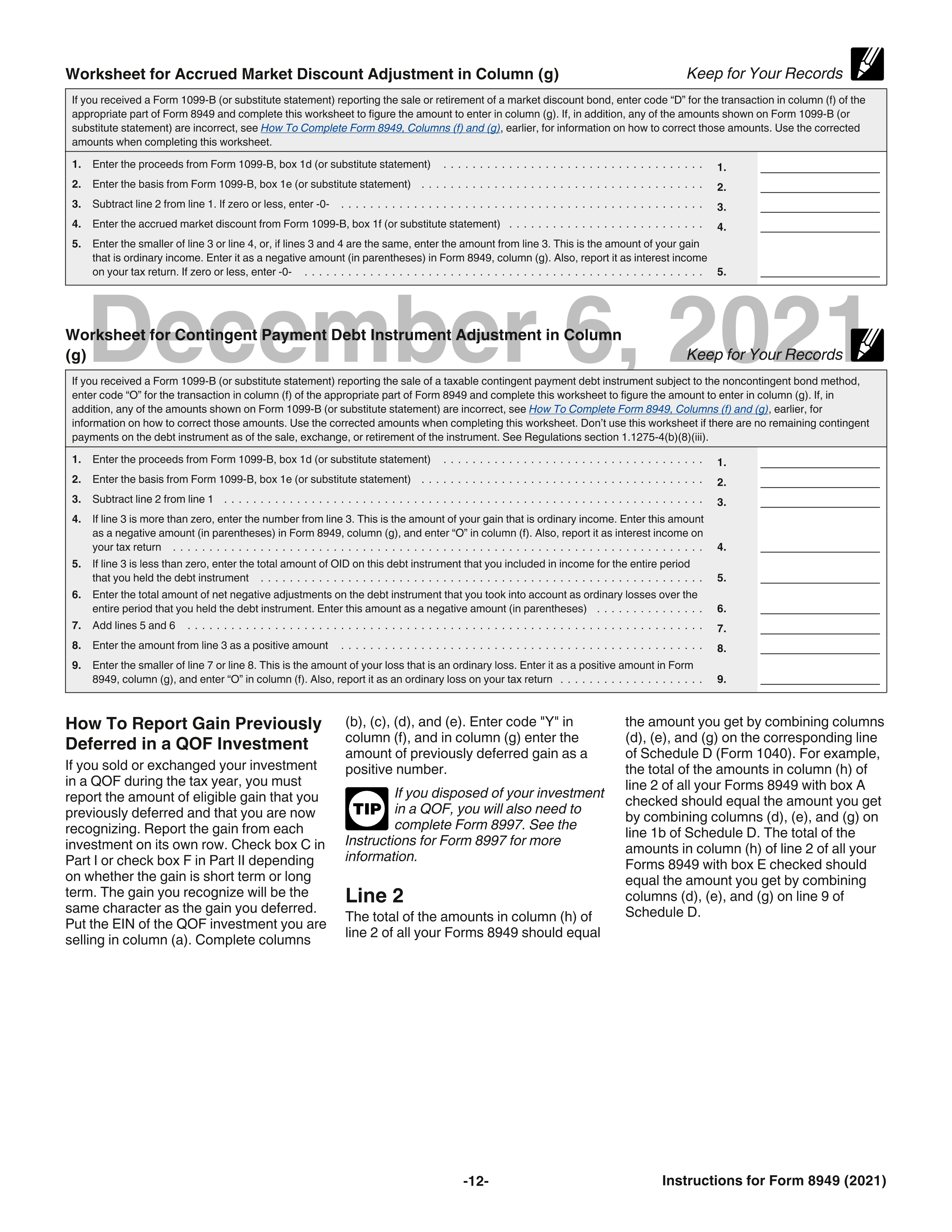

IRS 8949 2023 Form Printable Blank PDF Online, If you exchange or sell capital assets, report them on your federal tax return using form 8949: 17 rows use the worksheet for accrued market discount adjustment in column (g) in the irs instructions for form 8949 to figure the amount to enter in column (g).

You can find supplemental materials detailing all taxable dispositions for the year to complete your irs 8949, which includes date. We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

IRS Form 8949 walkthrough (Sales and Other Dispositions of Capital, Sales and other dispositions of capital assets. I have the transactions already in, but 2023 is not in the drop down.